Insurance Industry News

A collection of Insurance latest news, analysis and best practices from top business influencers and the world's most trustworthy sources.

Life Insurance for People with Diabetes

It can be easier for diabetics to qualify for life insurance than in the past, but insurers look more closely at the details of your condition now. The type of diabetes, your age at onset, your A1C readings and how you manage your condition can…

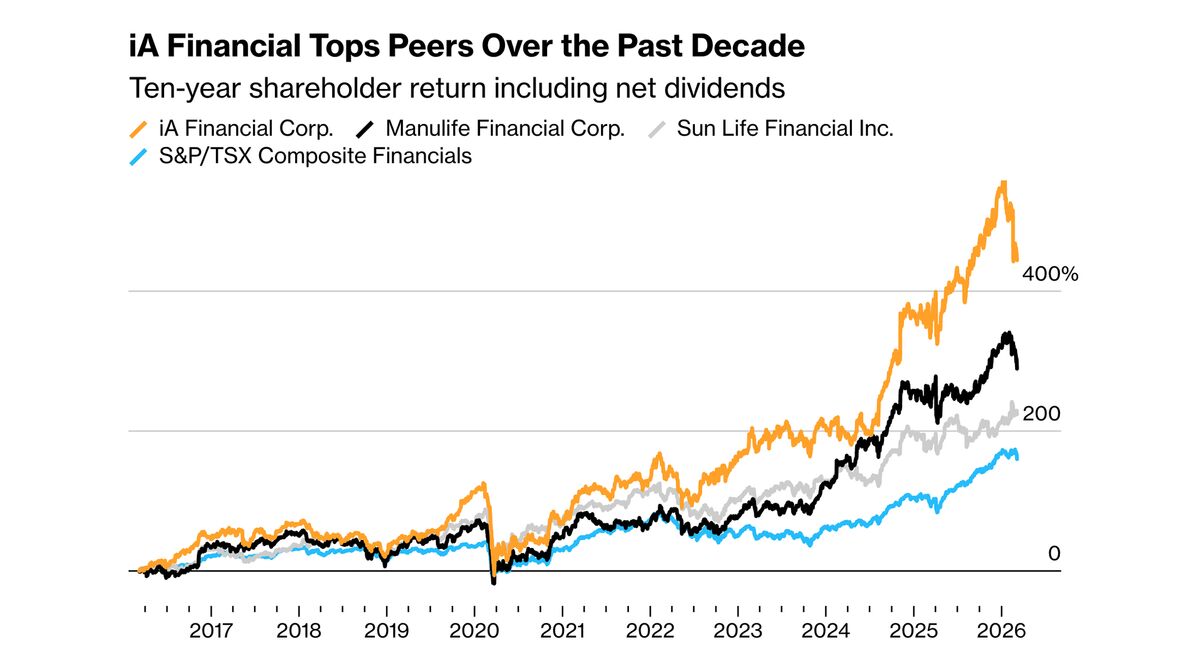

Mass-Market Insurer IA Financial Looks to US for Deals, Expansion

The head of Canadian insurer and money manager iA Financial Corp. is hunting for a multibillion-dollar acquisition after the firm reached a record valuation at the beginning of the year. Smaller deals are no longer enough to make a difference…

Cyber insurance could overtake property and casualty

23897e34-b870-42f1-ba3a-09acd9c5f5c8 Bermuda Risk Summit 2026: Reinsurance leaders Jerome Halgan, left Ryan Mather Kathleen Reardon and John Huff, chief executive of the Association of Bermuda Insurers and Reinsurers (Photograph by Akil Simmons)…

There's another big reason why shipping companies and insurers aren't willing to risk the Strait of Hormuz

Global insurers, brokers and shipping companies are concerned about an environmental catastrophe if an oil tanker sinks in the Persian Gulf. It's a massive risk in a region that stretches from Kuwait to Qatar — an area of glittering…

Heritage Insurance: Q4 Earnings Snapshot

TAMPA, Fla. (AP) — TAMPA, Fla. (AP) — Heritage Insurance Holdings Inc. (HRTG) on Monday reported net income of $66.7 million in its fourth quarter. The Tampa, Florida-based company said it had profit of $2.15 per share. The property…

Aon Tests Stablecoin Payments for Insurance Premiums

Aon, one of the world's largest insurance brokers, is testing the use of stablecoins to pay insurance premiums, highlighting the growing role of digital dollars in traditional financial infrastructure following the passage of the GENIUS bill last…

Heritage Insurance Holdings, Inc. (HRTG) Q4 2025 Earnings Call Transcript

Heritage Insurance Holdings, Inc. (HRTG) Q4 2025 Earnings Call March 9, 2026 9:00 AM EDT Ernesto Garateix - CEO & Director Mark Hughes - Truist Securities, Inc., Research Division Jon Paul Newsome - Piper Sandler & Co., Research Division Karol…

Hyundai Motor, Samsung Insurance to lead gov't self-driving testing

Hyundai Motor Company and Samsung Fire & Marine Insurance will lead the government's first citywide autonomous vehicle testing this year, aiming to develop the country's first production model that integrates manufacturing, insurance and platform…

Tampa insurance agent cast in Netflix's 'Age of Attraction'

The cast of Netflix's new unscripted series 'Age of Attraction' includes an insurance agent from Tampa. Why it matters: The dating experiment, a spiritual spinoff of 'Love is Blind,' follows 40 singles who will discover whether love is ageless. The…

Heritage Insurance outlines Texas entry and targets continued growth with 90% rate adequacy in 2026 (NYSE:HRTG)

Disciplined underwriting, rate adequacy in 90% of geographies, strategic capital allocation, operational efficiency, and technology enhancements are driving robust earnings and improved profitability. The Texas entry and deeper AI integration are…

Global insurance broker Aon tests stablecoin payments on Ethereum, Solana with Coinbase, Paxos

Aon (AON), which advises on $5 trillion in assets as one of the world's largest insurance brokers, said it carried out a proof-of-concept using stablecoins to settle insurance premium payments, an early sign that dollar-pegged tokens may start…

Aon Says Stablecoins Speed Insurance Premium Payments

Aon worked with Coinbase and Paxos to settle premium payments for their respective insurance programs, executing transactions across multiple blockchain networks, the companies said in a Monday press release. This successful proof of concept…

Iran War Is Costing Small Airlines $200,000 Daily, Insurer Estimates

The Iran war has had an obvious immediate effect on the Middle East's aviation insurance market, though the full financial impact remains uncertain. While some insurers told Skift that they are reassessing risk exposures and policy wordings, others…

Newrez is waiving lender title insurance on some refis

Multichannel mortgage lender Newrez has launched Newrez TitlePass for use in its wholesale channel, giving mortgage brokers a way to waive the lender title insurance requirement on certain refinance loans. This could potentially save borrowers…

Slide Insurance (NASDAQ:SLDE) COO Sells $213,291.00 in Stock

Slide Insurance Holdings, Inc. (NASDAQ:SLDE - Get Free Report) COO Shannon Lucas sold 11,700 shares of the stock in a transaction that occurred on Monday, March 9th. The stock was sold at an average price of $18.23, for a total value of…

Receive a Daily briefing on Insurance Industry News

Get Started